Quotes I am thinking about…

“Trends, like horses, are easier to ride in the direction they are already going.” John Naisbitt

“Mistakes in life don’t define who you are as a person, unless you let them.” Claire

Hop on the AI (gravy) Train! - A special rant with questionable benefits…

Unless one has been living under a desktop. By now they’ve certainly heard about the latest and greatest AI, Sora from OpenAI. Watch the prompts and then the video generated (above), really is quite remarkable. Content production of any kind can now become a commodity. Limited by imagination and compute power only.

What will this do to us? How simple and convenient will it be to immerse oneself into a custom designed reality? Don’t miss Matthew Ball’s most recent thoughts (below) on hardware from Meta and Apple that make this a distinct possibility.

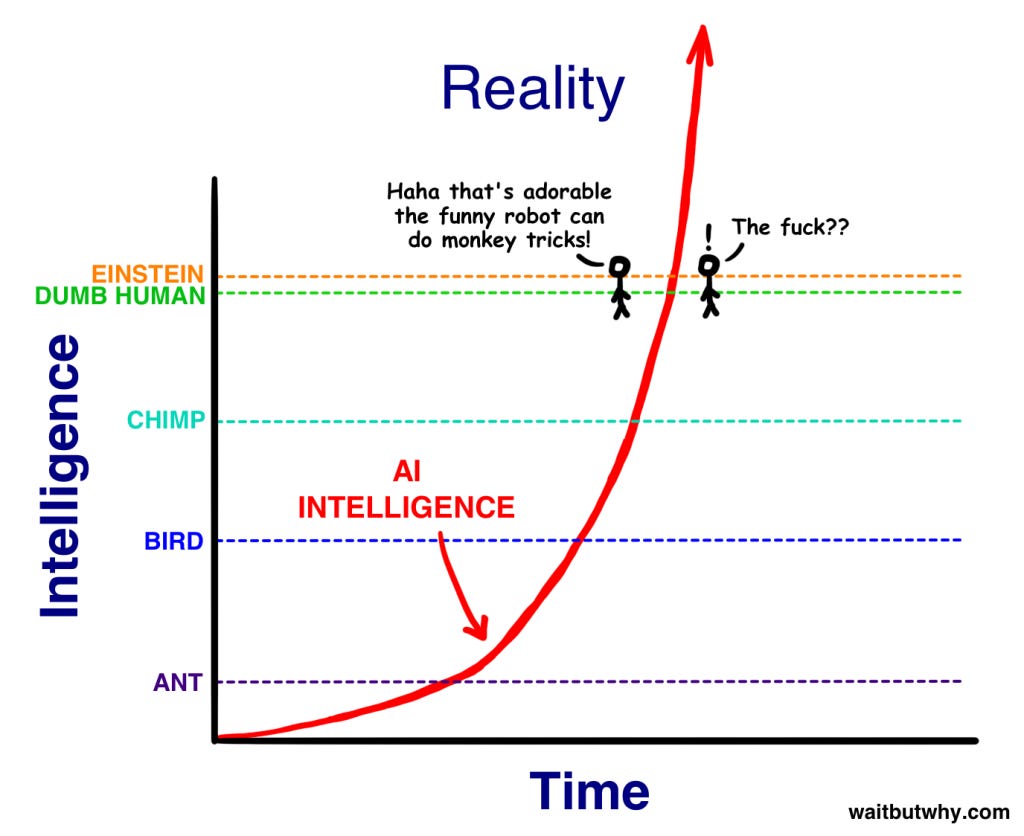

These step change improvements in artificial intelligence are becoming unfathomable. Especially for the old dial-up internet peeps out here (like me). Brought starkly into light after watching the recent video interview (below) with Nvidia Founder Jensen Huang. Throughout I was reminded of a graphic from Wait But Why (www.waitbutwhy.com) shared a long, long time ago. (2015)

Now that most of us are starting to see how real the profane is in that picture.

What the F is one to do??

George Carlin said “If you can't beat them, arrange to have them beaten.”

So just master these AI tools. ‘Cause that is what they are, tools.

Learn to use models as a semi-intelligent (sometimes unreliable) advisor. Use them to apply basic logic and confirm or deny a starting hypothesis. Then go deeper into a conversation with that new avatar. This process (the interlocutor if you will) has become so much better recently, I cant get myself to “Google” things anymore. Something I’d done for years on end like everyone else. (Side note: Is this part of the “enshittification process? - see below) Now, with a new found ability of some models to keep larger amounts of short term memory. Does it become superfluous to actually read most anything that is online? Barring Dostoevsky, of course. 🤓

I know, I know. That sounds ludicrous, delirious and alarming even. We know that at the depth of something. Grasping for nuance, one needs exposure to an original. And simulacra will not suffice, not yet. But you dear reader are the final judge and arbiter. When AI writes more efficiently, succinctly and beautifully. Will we still need prose?

In the mean time indulge some time of your own. Please start a conversation with a LLM. Especially if you’ve never done so before... It’s akin to providing instructions to a person rather than complex code for a machine. Maybe even try to automate a task in a job you do or want to be done a certain way.

LLM Recommendations:

Super fast browser based LLM - https://groq.com

Android/Apple App based (download from app store) - https://www.perplexity.ai/

Take these for a spin and let me know what you think? Inbox always open!

And if all that seems like too much - simple videos to learn more are here 👇

Wharton Interactive Crash Course: Practical AI

If this guy can die and come back better, so can the rest of us….✌

Market Commentary

Greatest trick a bull market ever pulled was convincing the bears that it didn’t exist.

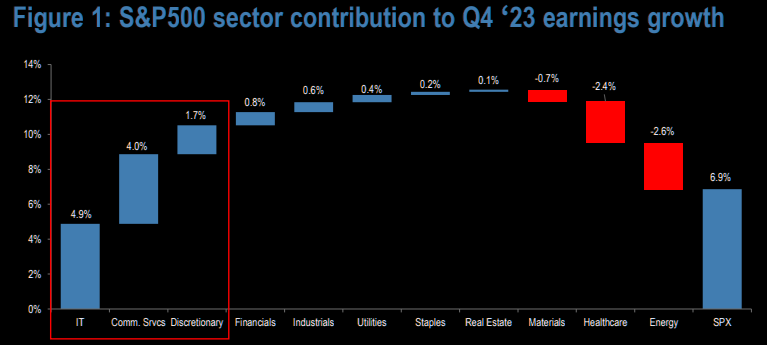

The growth in tech earnings from the already stratospheric levels is absolutely 🤯

Truth be told, I wasn’t as sanguine about US Corporate profits a year ago.

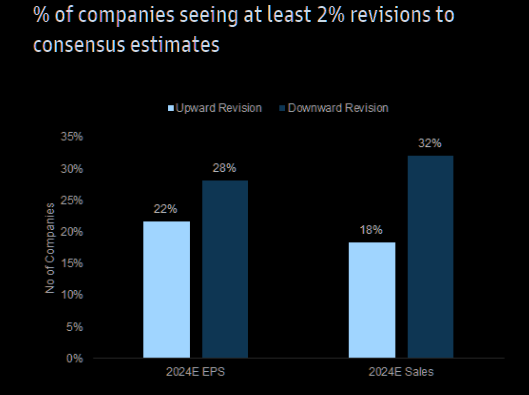

While the doom and gloom crowd pontificate, statistically it pays to be positive.

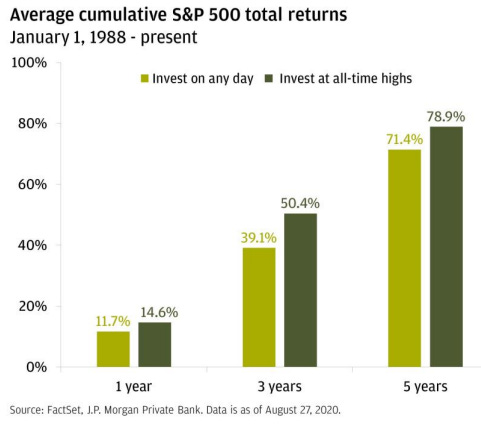

And more so when markets are at all time highs in the US (JPM data above).

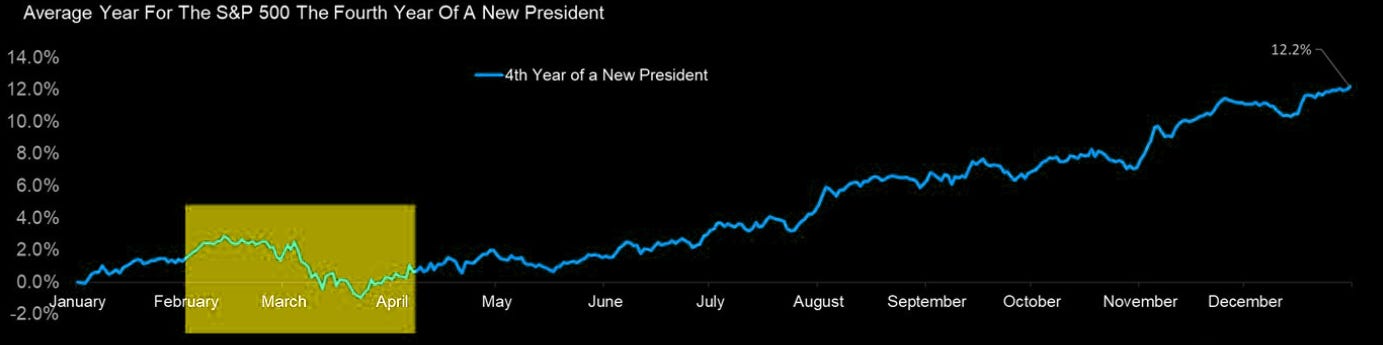

Avid readers know my proclivity for a seasonal view, here is what that looks like now…

Weak (in yellow above) going into the next couple of months.

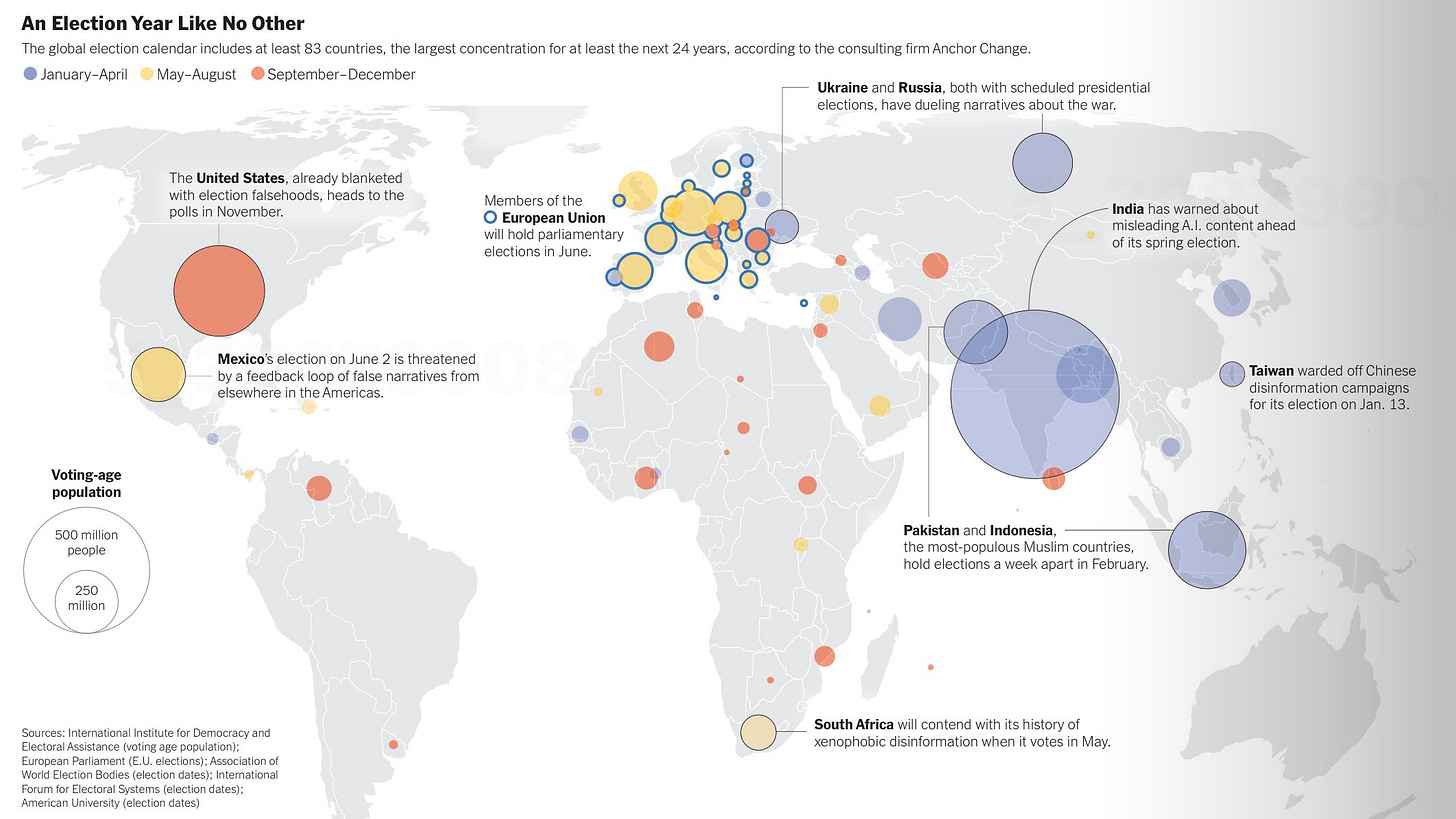

And then….👇 elections slated for 2024. You know where I sit and stand.

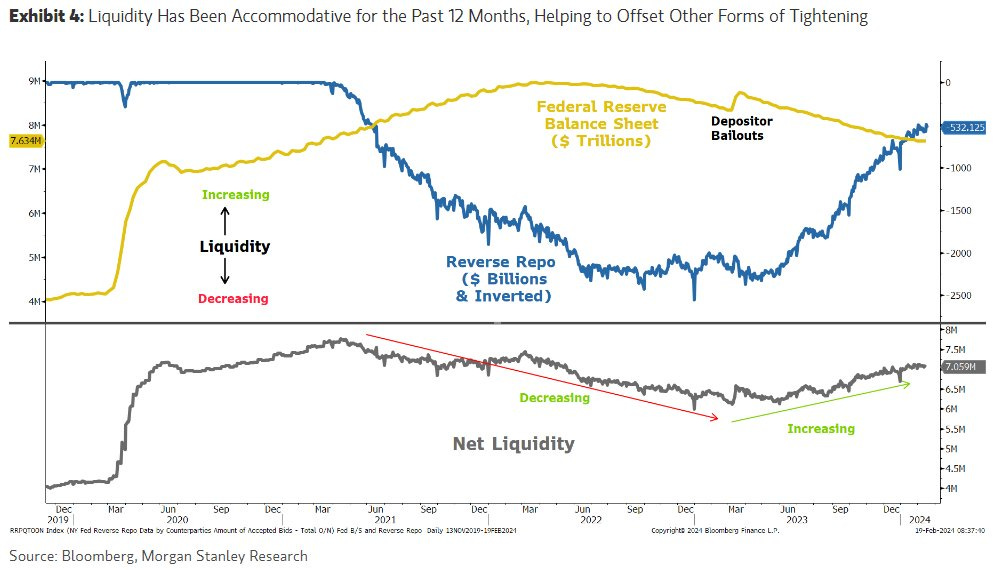

Highest signal to noise? Net liquidity trajectory is on the bottom of chart below.

Everything it is said, has already been said better. So I find myself using another’s words to express how to think about the setup.

"Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance."

- Jessie Livermore - Reminiscences of a Stock Operator

As always your ❤ and comments are what make this endeavor fruitful.

Keep them coming 🙏

Stay safe out there!

Cheers,

Faiz

Interesting Reading Roundup - IRR

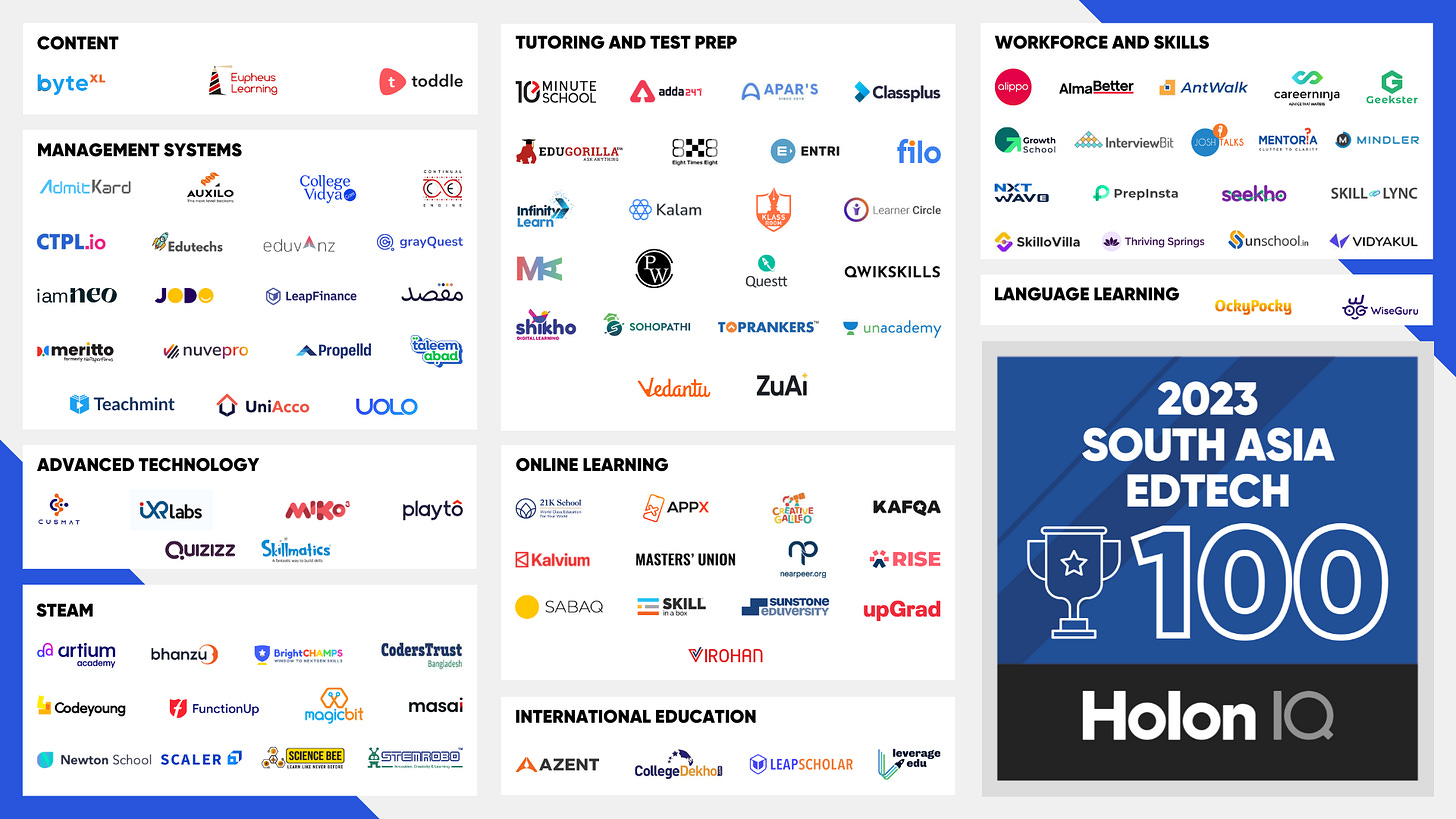

Edtech - India - ‘Ctrl P’ Netflix Model

Netflix's business model could be a game-changer for online learning apps in India. Attributed to its focus on creating engaging content that caters to the diverse interests of its audience. Online learning apps in India can learn from Netflix's approach and create content that is not only informative but also engaging and entertaining.

Key Point - Importance of creating localized content that resonates with the audience, offering a personalized experience for users, and using data analytics to understand user behavior and preferences. Netflix's success in India has been driven by its ability to offer a wide range of content in various languages, which has helped it reach a broader audience.

This approach can help online learning apps in India overcome the challenges of low engagement and high dropout rates, and ultimately create a more effective and sustainable learning experience for users.

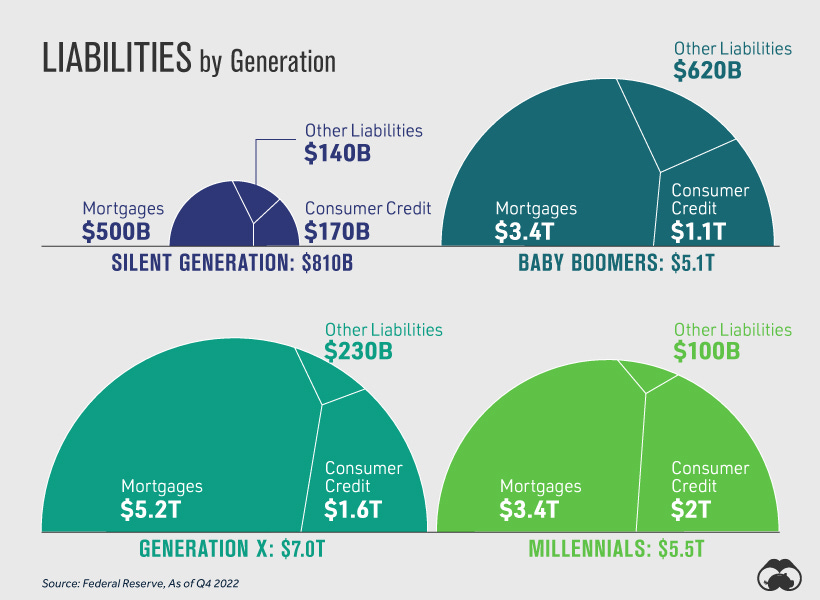

Wealth Management - Family and generational wealth strategy

Interesting quote: "Unfortunately, the short run always comes before the long run, and neither of us got to enjoy the rebound of these investments. The lesson: good investments plus bad sizing can result in cataclysmic losses."

Even wealthy families struggle to maintain their wealth over time, citing the example of Cornelius Vanderbilt's descendants. They squandered their inheritance within three generations.

Key Point - Argues that the problem is not poor investment choices, but rather poor financial decisions. Such as overspending and not adjusting spending as wealth fluctuates. The most important financial decisions are not about what to invest in, but rather how much to invest and how to manage risk.

They share their personal experiences with losing wealth due to poor financial decisions and highlight that even professionals are not immune to these mistakes. Investors should focus on making better financial decisions, rather than just relying on good investments.

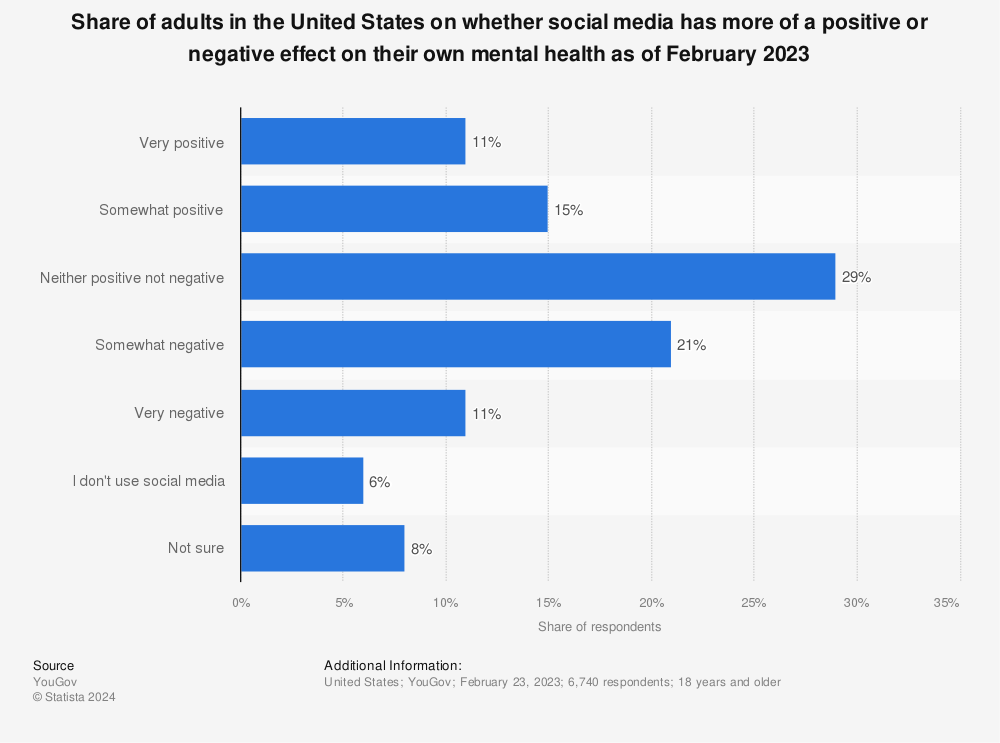

Tech - Hedonic Treadmill - Apps get “shittier” as time passes

Interesting quote: "But in case you want to be more precise, let’s examine how enshittification works. It’s a three-stage process: first, platforms are good to their users. Then they abuse their users to make things better for their business customers. Finally, they abuse those business customers to claw back all the value for themselves. Then, there is a fourth stage: they die."

Discusses the concept of "enshittification," a term coined by the author to describe how platforms and services become worse over time due to the prioritization of profits over user needs.

Key Point - Identifies four forces that can discipline companies and prevent them from engaging in enshittification: competition, regulation, self-help (users' ability to find ways to counteract anti-features), and workers (tech workers' ability to resist or quit their jobs if they disagree with the company's practices).

Understanding the causes of enshittification is essential to addressing the problem and preventing its continuation.

Futures made of virtual insanity - MetaAppleVerse (trademark pending)

Interesting quote:

"Facebook’s network of apps are a, if not the, primary thing that many internet users do on their computers — computers that Facebook doesn’t make. For similar reasons, Apple is more focused on “the real world” — which its devices live in and are used to interact with – than Meta, which is a digital forum. As a free service, Facebook has been able to reach 3.2 billion people on a daily basis out of the 4.6 billion total Internet users outside of China. Apple has 1.5 billion including China. Some of Facebook’s users generate only a few cents a year; nearly all of Apple’s generate hundreds.

These differences manifest in the timing, price point, and construction of their HMDs (head-mounted displays)."

Matthew Ball, a leading thinker on the metaverse, discusses the concept of spatial computing and its role in the development of the metaverse. He explores the history of spatial computing, its current state, and its potential future.

Key Point - The concept of the metaverse and spatial computing is becoming increasingly important as technology continues to advance. While the metaverse is still in its infancy, the potential applications of spatial computing are vast and could have a significant impact on a variety of industries.

The man with a Midas touch - GQG Partners - Rajiv Jain

Rajiv Jain, the founder and Chief Investment Officer of GQG Partners, has a bullish outlook on the technology sector, particularly in semiconductor stocks like Nvidia and Meta. He believes that the industry is undervalued and that the current environment is similar to the early stages of the Nifty Fifty episode in the early Seventies. Jain also likes tech in general and notes that AI could be a game-changer for the industry. Additionally, he mentions that Novo Nordisk and Eli Lilly are two of the hottest stocks in the healthcare sector, and he still likes Novartis in Switzerland. However, he believes that Roche has been stumbling and is currently on the bench. Jain notes that valuations in Europe are attractive, and he likes some of the banks in Europe, such as BBVA.

Additional depth - Brilliant recent podcast with Rajiv shared below…A masterclass in independent thinking by first principles.

Future - Could NVIDIA be the most important company in the world?

A Conversation with the Founder of NVIDIA: Who Will Shape the Future of AI?"

Jensen Huang, the founder of NVIDIA, discusses the significance of NVIDIA in the artificial intelligence (AI) space and the future of AI technology. He expresses enthusiasm about the advancements in AI, which is at the beginning of a new Industrial Revolution, and the transition to $2 trillion worth of data centers powered by accelerated computing. Huang emphasizes the importance of democratizing AI technology to prevent a divide between "halves and have-nots" and encourages countries to invest in their national intelligence. Huang also discusses the role of open source systems and GPUs in the development of AI and the accessibility of technology in various domains, from digital biology to manufacturing and farming. Huang imagines a future where everyone is a technologist and AI is widespread.

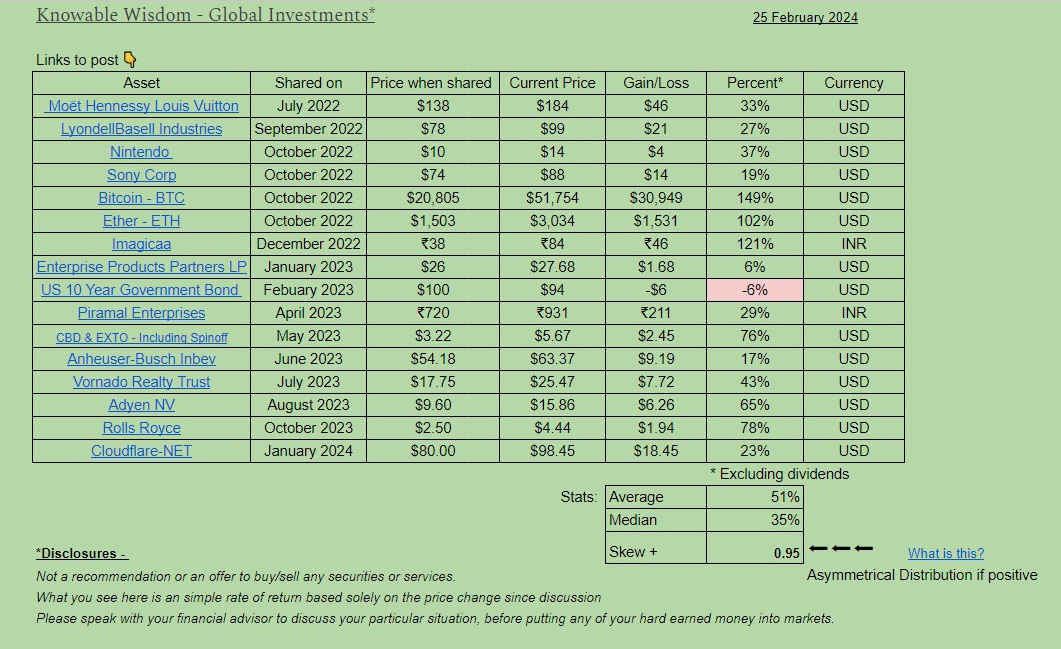

Scorecard -

There are some fundamentally sound investments, that are moderately under valued among these...Please be kind and recycle 🍻