Some quotes I am thinking about….

“The price of anything is the amount of life you exchange for it.” - Thoreau

"I believe you can speak things into existence." - Jay Z

Hap hap happy 2024 folks!

2023 was a much better year than most (including me) expected.

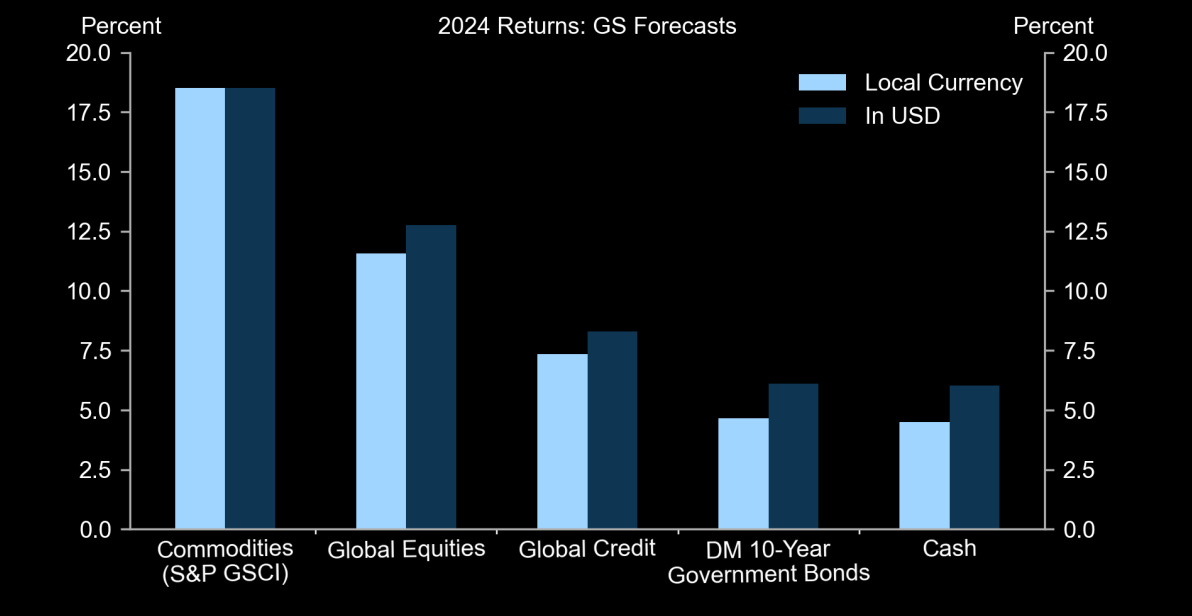

2024 is now forecast to be a party you don’t want to miss.🥳 <Contrarian much?>

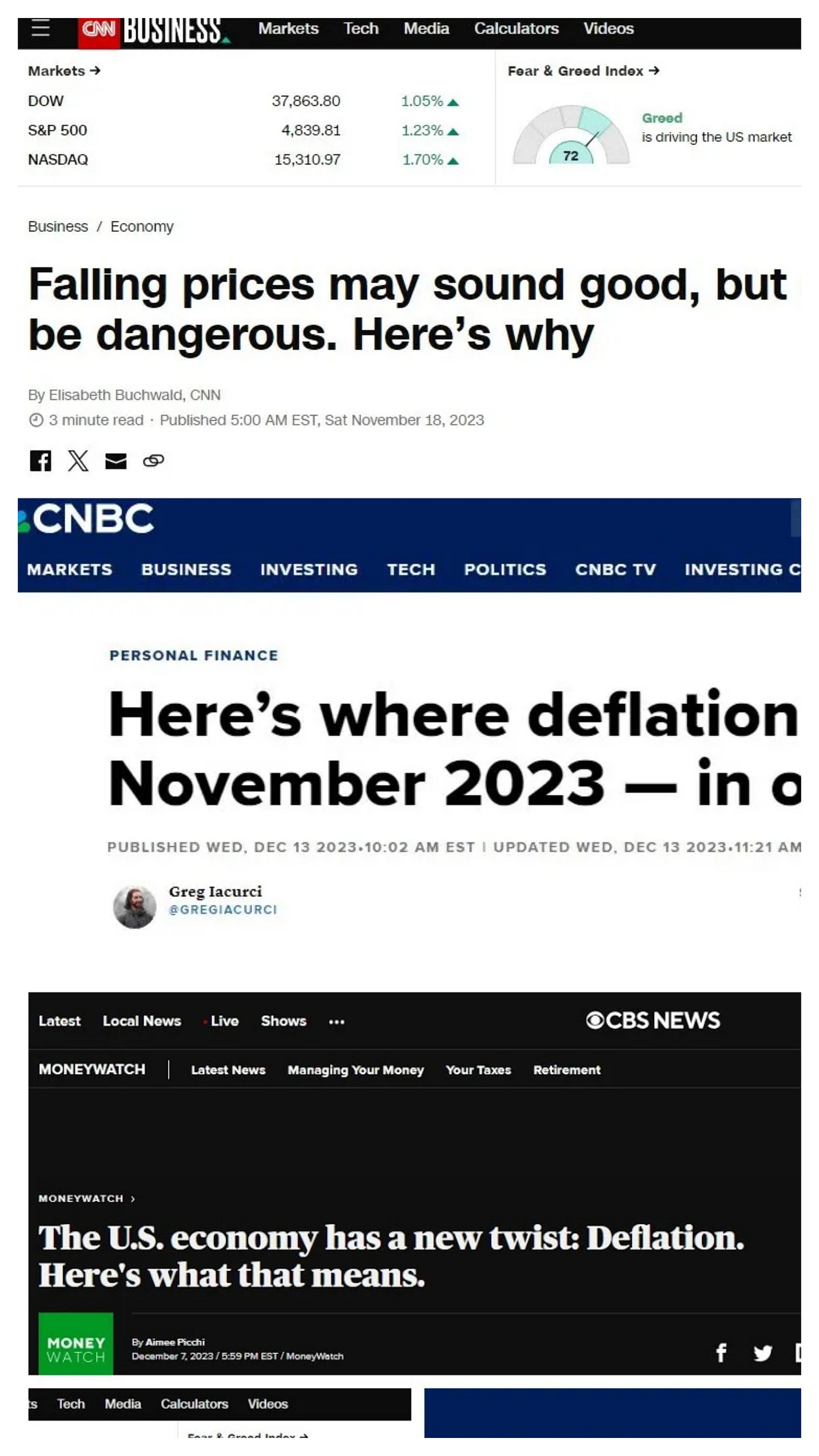

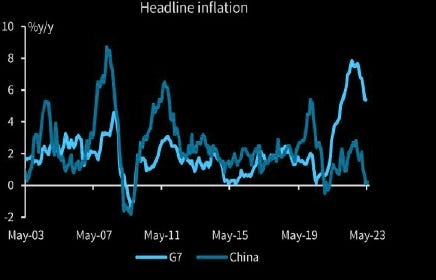

The big D (deflation) word is making the rounds as expected. There will be more of this to come in the year as well. 🤠

One global giant is exporting deflation. Other giants import it and issue IOU's.

Can you tell which one is which? And can you tell which is more sustainable?

If you are confused, don’t worry, so is everyone else. And don't let anyone tell you otherwise.😜

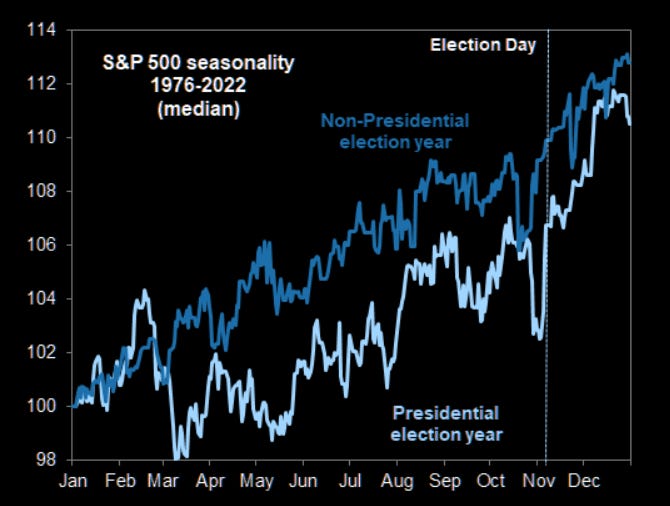

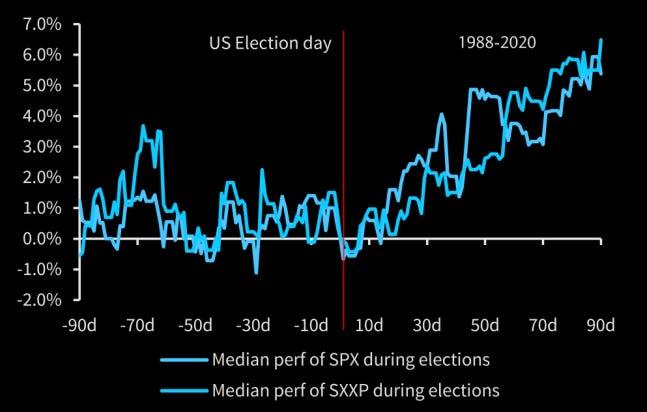

So what's next? Highest number of elections around the world (ever?) in 2024. What will keep the populace happy?

Let's invert..what would make the populace unhappy? A falling stock market and a negative wealth effect. And if history is any guide, kitchen sinks will fly if so much as a hint of such an occurrence appears.

So with my finest tin foil hat AND my horrible accuracy with prediction.🧿

2024 is shaping up to be a blockbuster year for all assets. *

Albeit, once we have peacefully selected our overlords…🤞

Only to be derailed by some heretofore unknown disaster we don’t see coming…🤷♂️

War, pestilence and disease, this market just takes it all and keeps on trucking.

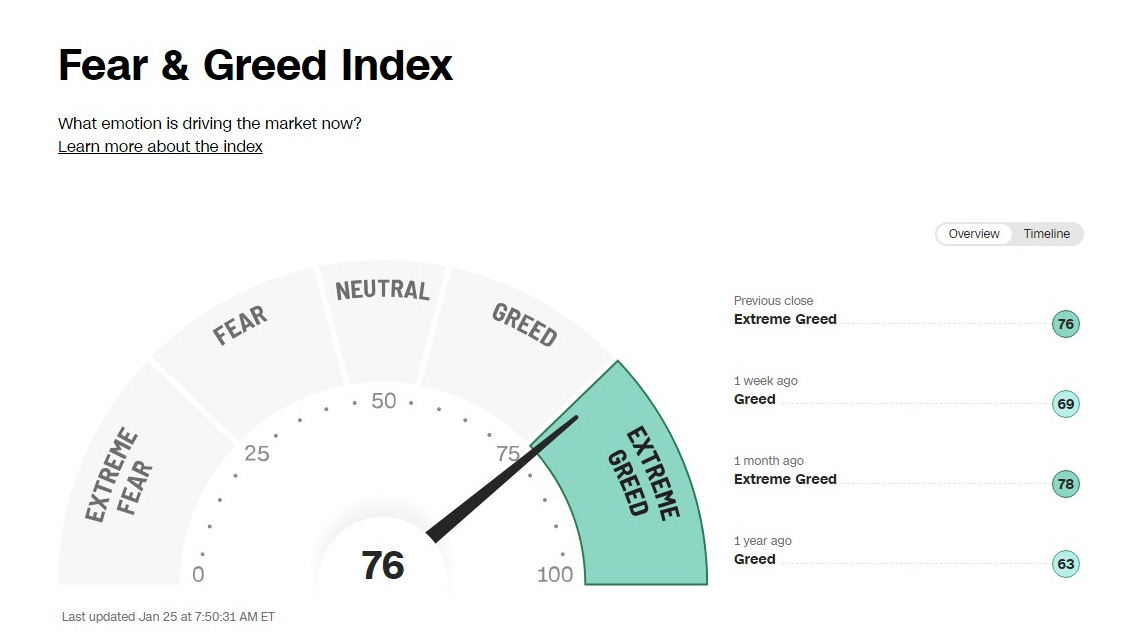

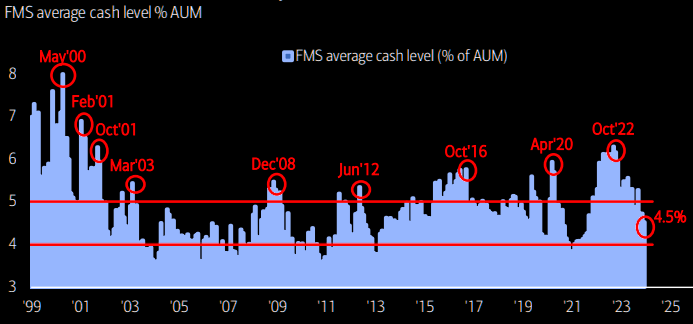

Greed is good right? How about Extreme Greed?

CNN Fear Greed Index is saying something. But is anyone listening?

‘Don't fight the Fed’ they say. Here we are at all time highs with FOMO making a comeback.

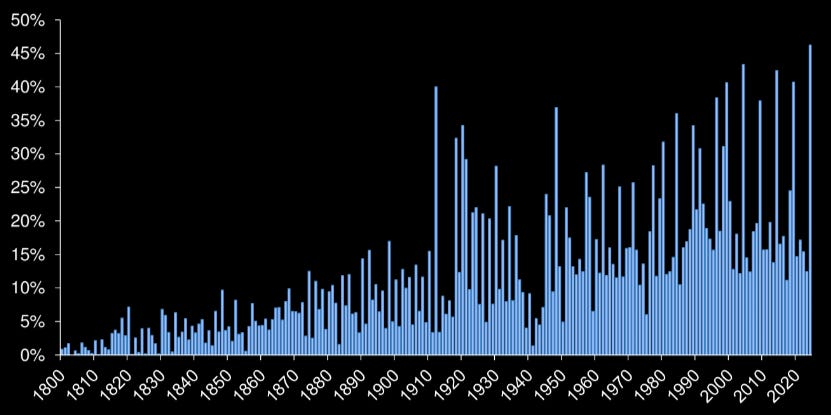

Bubbles are fun aren't they? (Do check out the article on tulip bubble below- it is eye opening)

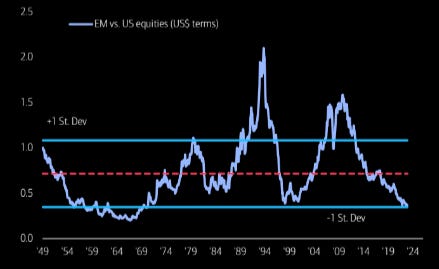

A new year gift in the works from Mr. Market. Anyone up for a mean reversion trade that has been over a decade in the making? *

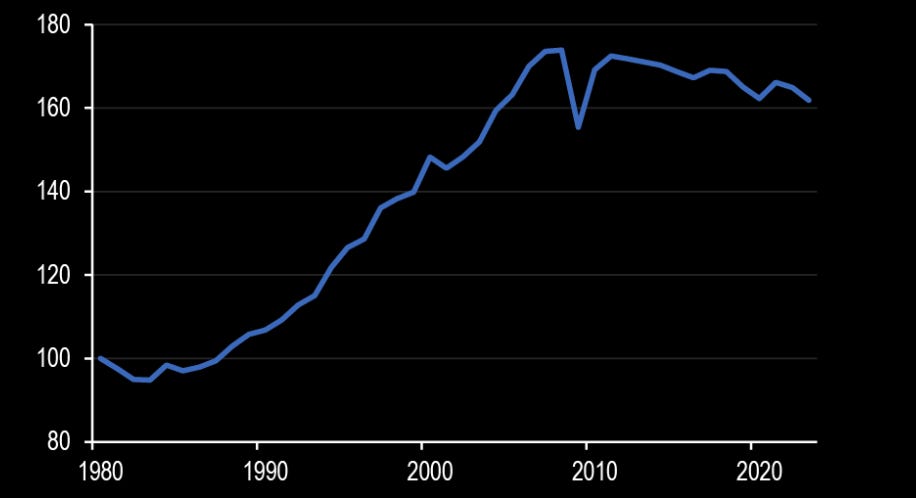

Chart below shows US vs EM Equities at a -1 Standard Deviation. (Read: Statistically Undervalued)

Not all EM’s are the same however as some will bask in the limelight. While some remain ignored and possibly misunderstood.

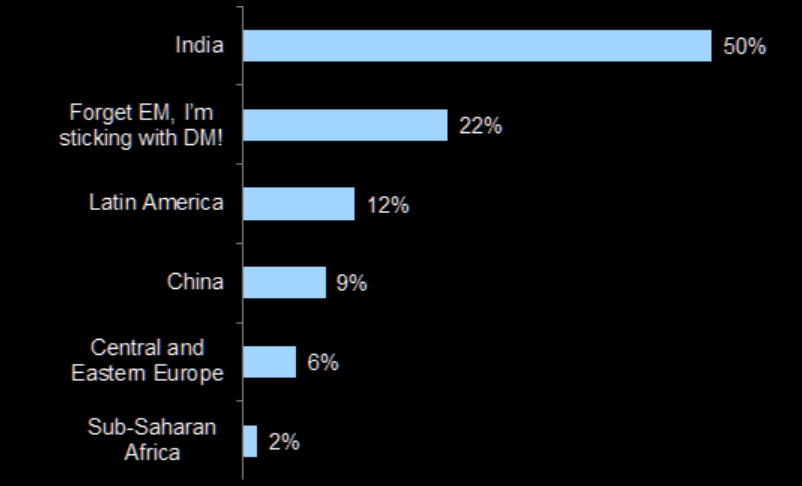

Question to respondents at GS Global Strategy conference, London January 2024 : “Which EM economy/region provides the best long-term investment opportunity?"

A unanimous winner! 🥂💰

Commodity producers (LatAm countries like Brazil, Colombia) still screen cheap. Maybe right or wrong, but certainly a less crowded space at this time.

Highest signal noise?

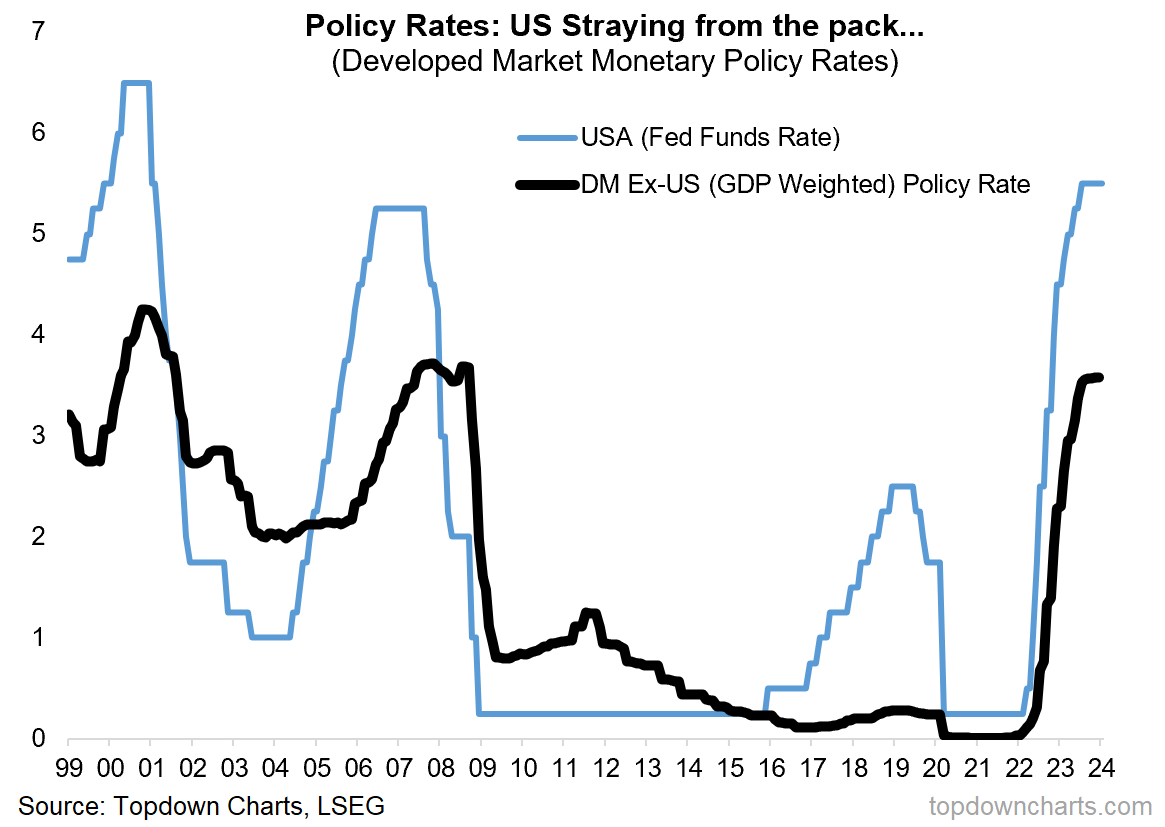

Rate differential between US and other developed markets. As this starts to converge. The second order effects on emerging markets equity/bonds and Gold will be palpable.*

The biggest spoilsport a higher USD and US rates/inflation (geopolitical risk?) along with a tight US labor market.

Some questions that I ask in the first month of this new year are such…

With all the geopolitical crap (pardon my french) going on….When will something break? Systemic risks are funny that way. Don’t announce their arrival ever. Just kinda show up at your door to say, hi!

Now that the crowd is beginning to hear the deflation hypothesis. Let’s ask where is inflation hiding out now? When and where will it show up again? What does the inflection point look like? (Iran, Houthis, Gaza, North Korea, Taiwan, oh yeah and maybe even Ukraine?)

Finally, what if everything is going to be alright after all? It is an election year and remember we need to be entertained! Right?😉

That is it from me for now…

Some quality listening, reading, watching and a quote below that I think aptly summarizes my current view, especially on any ‘sure thing’ as they call it.

“I tell my father’s story of the gambler who one day hears about a race with only one horse in it, so he bet the rent money. Halfway around the track the horse jumped over the fence and ran away.” ~ Howard Marks

Thank you as always for your time and the indulgence.

Stay safe out there!

Cheers,

Faiz

Please don’t be too shy to jump over and hit ❤ or leave a comment below if you enjoy these posts. It is the only way a small blog like this can grow and for more of us to grow together…Spread the love!🙏

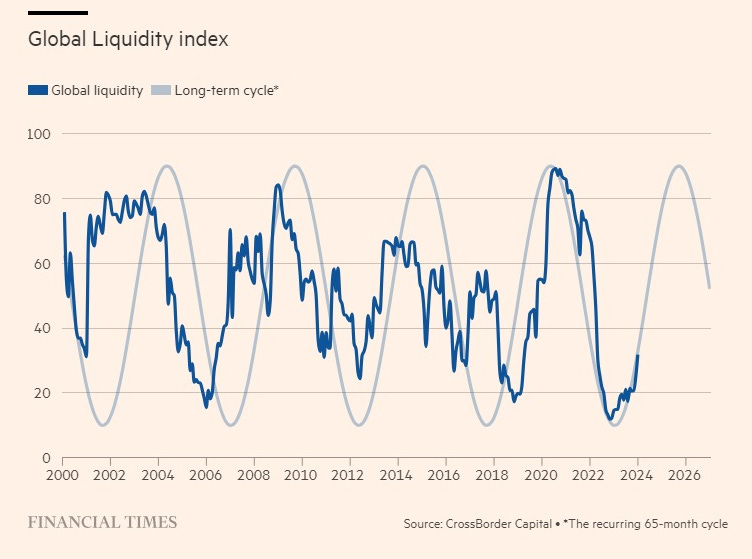

Is liquidity more important than interest rates?

It is not only interest rates that matter in a world where vast stocks of existing debt have to be regularly refinanced. The balance sheet capacity of the world’s credit providers is also critical.

Now liquidity conditions appear to becoming easier, with international funding markets finally thawing. Rising bank share prices over the past two months and the crowded new year corporate issuance calendar provide evidence of that.

Our research suggests flows of global liquidity accelerated higher into early 2024, expanding by 9 per cent at an annual rate from September, led by strong increases in Japan and China.

A tulip fever that almost, never was at all - Bubbles - History

In fact, “There weren’t that many people involved and the economic repercussions were pretty minor,” Goldgar says. “I couldn’t find anybody that went bankrupt. If there had been really a wholesale destruction of the economy as the myth suggests, that would’ve been a much harder thing to face.”

Berkshire - Active Management - Value Investing*

The purchases bring Berkshire's stake in Occidental to about 27%. The company also holds preferred shares and warrants to acquire another 83.8 million Occidental shares for $4.7 billion, or $56.62 apiece. The shares and warrants were obtained as part of a deal that helped Occidental finance its 2019 purchase of Anadarko Petroleum. If exercised, the warrants would bring Berkshire's total ownership to 33%.

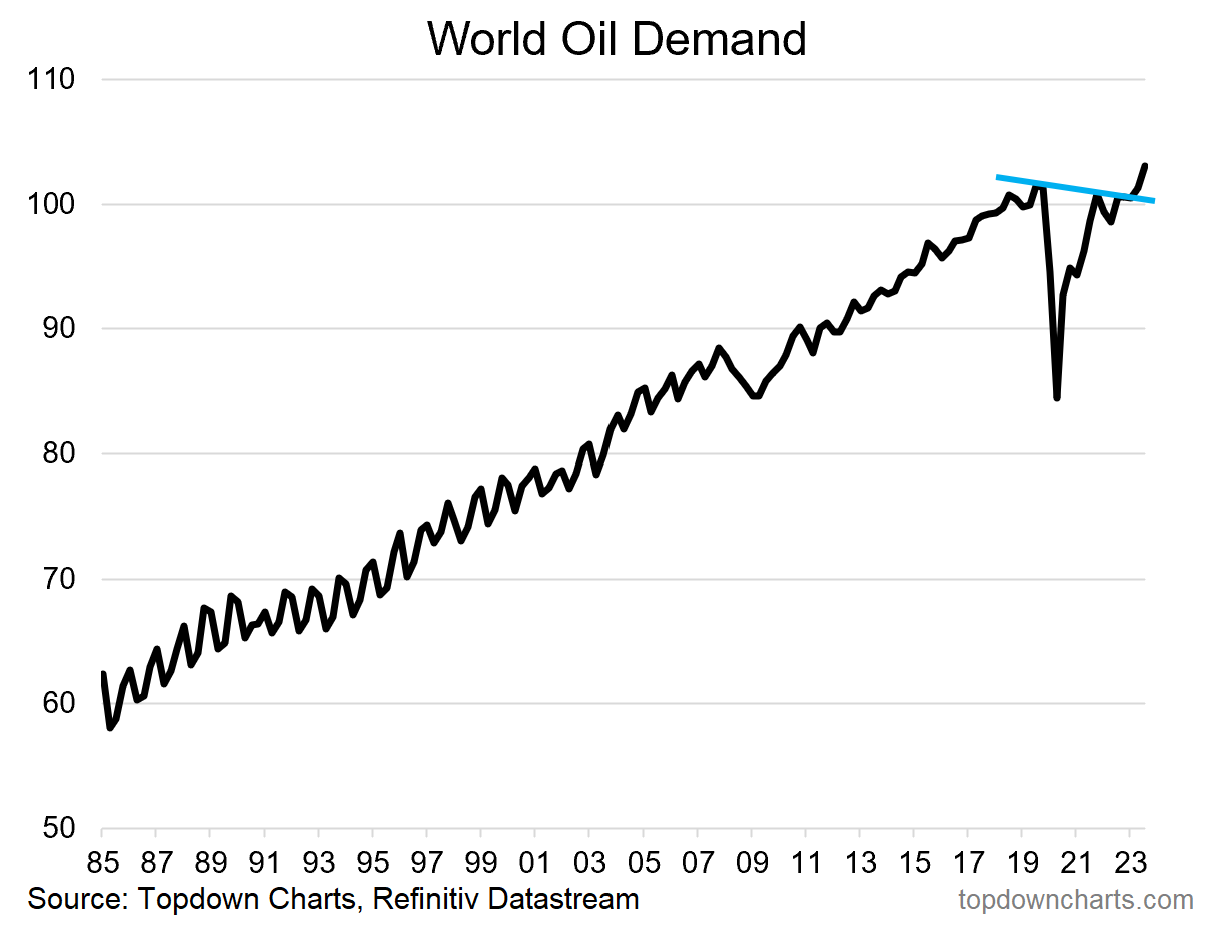

Occidental (OXY) - Carbon Capture - Carbon Neutral Fuels*

Some investors and analysts view Oxy's direct air capture projects as a hedge — sort of like an insurance policy. If oil demand stays high, Oxy will happily sell the world oil; if it drops, Oxy can pivot to carbon removal. Alternately, direct air capture could be a way to extend the life of Oxy's highly profitable oil business. Not an insurance policy in case oil demand drops, but an effort to keep it high and make oil more profitable for longer. An Occidental executive told NPR both those interpretations are "incomplete," emphasizing that direct air capture could be a revenue stream in its own right and provide a new way to monetize Oxy's existing skills and resources

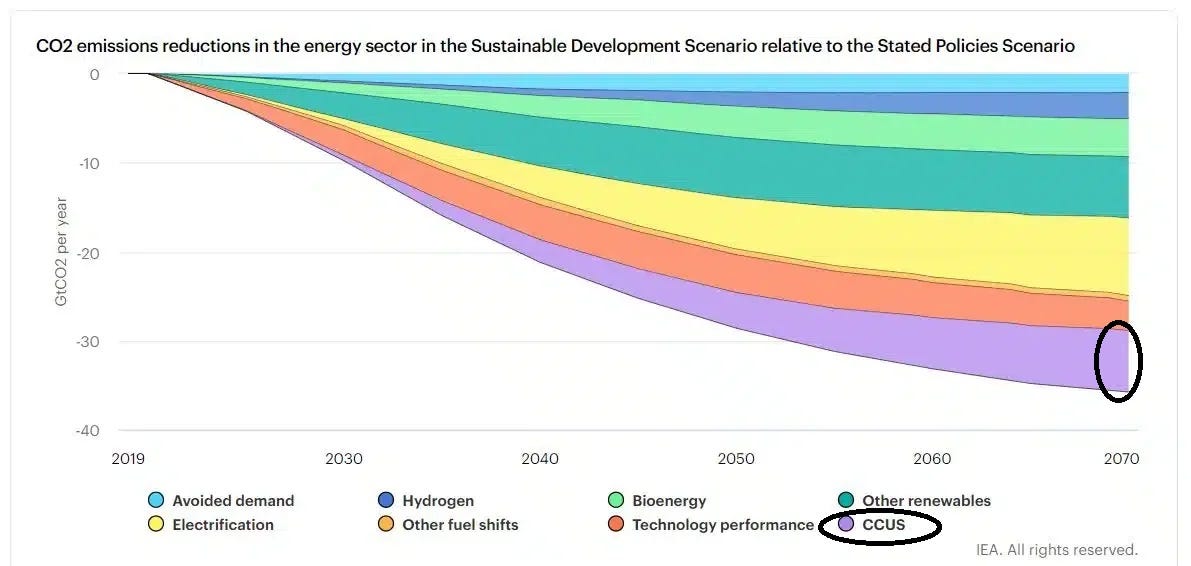

Carbon Capture and Removal - COP28 - Global Environmental Standards

The COP28 conference's hosts, OPEC member the United Arab Emirates, is promoting the use of carbon removal - a family of technologies to keep excess CO2 out of the atmosphere - as a means of reducing emissions from fossil fuels, as opposed to eliminating the fossil fuels themselves. Scientists have said carbon removal is needed to keep climate goals alive. That approach has the backing of global producers seeking to continue profiting from fossil fuels, but draws skepticism among environmentalists and some governments who see it as a ploy to prolong the lifespan of oil and gas and who are pushing for tough language at COP28 to phase out fossil fuels completely.

International Frameworks - Economic Impacts of De-globalization

Should the current international framework be allowed to fail, it will not be replaced by a new system anchored by China but by more global disorder.

Such an outcome would hurt everyone in the short term. It would also inhibit our collective ability to tackle the complex and growing long-term challenges we face.

Squeeze on Small Business - Global Interest Rates - Access to Capital

Stock Talk - NYSE: NET Cloudflare - Guardians of the Internet - *

A biased and one sided view by an unabashed fan of the company. And yes, I do own this one too.

Please Do Your Own Research

This is not a recommendation or an offer to buy or sell securities.

🤖 Guardians of the Internet ☠

Entering the sprawling metropolis known to us as the internet, digital avenues stretch out as far as the last pixel one can see. There exists an unseen force here, one that keeps the digital universe’s heartbeat pulsing—touching a staggering 25% of all internet traffic. This sentinel started out as a mere foot soldier, a distributed content delivery net…

Kalpen Parekh, MD & CEO - DSP Mutual Fund on Wealth Creation -

Video Synopsis -

Ways to navigate market volatility -

a) conservative asset allocation and,

b) time diversification by SIPs & STPs

Why folks prefer to invest in funds with good past returns rather than future potential- Difficult to fight ‘Recency bias’ of the human mind.

Why buying into past performance not the best policy - You give an exit to the guy getting out IE. help others monetize fund’s past performance. While you might make average returns.

Volatility affects both Active & Passive index funds - Newbies can commence market journey with SEBI registered advisors for working out asset allocation/ low-cost fund strategy. But if investing directly, start by choosing passive funds managed by good managers.

Diversify - Markets have cycles. To protect against any short term volatility/ corrections of Equities, portfolio should include bonds & gold.

Radiolab Podcast - Stochasticity - Randomness

“Stochasticity (a wonderfully slippery and smarty-pants word for randomness), may be at the very foundation of our lives. To understand how big a role it plays, we look at chance and patterns in sports, lottery tickets, and even the cells in our own body.

Stochasticity (a wonderfully slippery and smarty-pants word for randomness), may be at the very foundation of our lives. To understand how big a role it plays, we look at chance and patterns in sports, lottery tickets, and even the cells in our own body.

Along the way, we talk to a woman suddenly consumed by a frenzied gambling addiction, meet two friends whose meeting seems to defy pure chance, and take a close look at some very noisy bacteria.”

Memestop 😉