(Does not constitute as a recommendation or an offer to buy/sell securities)

I have been discussing this stock with an investor who owns Piramal Enterprises (PEL) since last year. Luckily for me, it has become a lot cheaper since, dropping by more than half. Caused by a de-merger of Pharma business and some aggressive provisioning for possible non-performing assets. Still at a INR 17K Cr market cap, so not a small company by any measure. This sell off is an overreaction by the sellers I think. As provisioning is not a permanent loss. Provisions can be written back if loans don't go south. This is not unheard of for Banks and Non-Banking Finance Companies (NBFCs).

The current reach of Piramal with their DHFL acquisition is not easy to replicate. Lower borrowing costs and higher operating leverage will kick in over the next two years. Perhaps the current negative narrative/story around the stock will change eventually. Once upon a time Mr. Piramal was called the Warren Buffett of India . And his relationship with Ambani is also well known. How this all comes together in the end I don't know exactly. Suffice to say, this too shall pass.

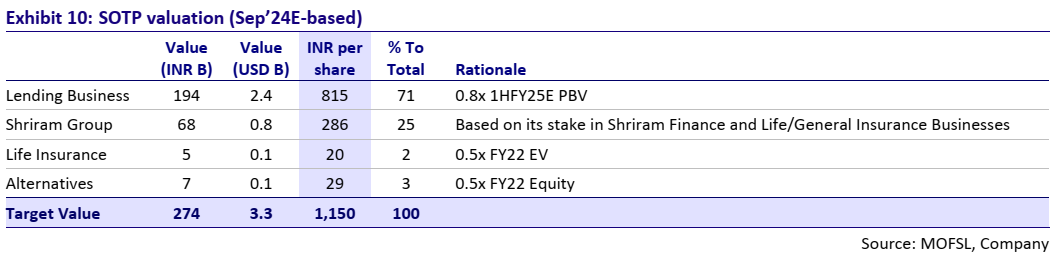

The primary reason I'm pulling the trigger now, is that the price has dropped significantly below book value (current price 720 - Book Value 1150). For a well managed NBFC business with low implicit default risk, that seems very pessimistic. I do not think the current haircut of 40% from book value to market value is justified. I view buying this as allowing an exit for those investors who equate uncertainty, with a risk of permanent capital loss. Ajay Piramal might be a lot of things. But for him to cheat, be greedy or supremely stupid, are all not very likely...based on decades of his painstakingly built reputation.

If you want a refresher on Ajay Piramal’s capabilities as I did - here is a quick read:

On the flip side, in a long and drawn out recession, this stock could go nowhere for some time. Lots of negative press and sentiments are already priced into the stock at the moment. Debt is an issue for some. But because it's long term debt, I'm not too concerned about an asset liability mismatch (i.e. they are not borrowing short term money to make long term loans like DHFL etc). Looking out to FY24 the stock should easily be higher based on their growing Assets Under Management trajectory. Even more so if they execute on the same baseline that Ajay Piramal has done in the past.

Current price assumes very little goes right from here. The equity value is at a haircut circa 40% of book value. I'm betting things just won't be or get as bad. Buying at 720 a share the investment in Shriram group, the life insurance JV with Prudential USA and the Alternative investment platform with CPDQ are basically coming to us for free.

This is a bet on the jockey more than the horse, in some sense.

Fair disclosure, I own a decent bit bought between 699 and 720. With hopes to add more on any weakness in price. Since this is a large cap, the margin of safety here is high in my opinion. So I bought a 1/2 allocation immediately. Now I plan to add in 1/4th allocation tranches over the next couple months. As the thesis plays out. What this means is if I have a INR 100 investment planned in total. I buy 50 now + 25 later + 25 later.

As always please do share any insightful color, commentary and any variant views that you may come across.

Cheers,

Faiz

(Does not constitute as a recommendation or an offer to buy/sell securities)

Assume that I may hold positions long or short in the above stocks. This discussion is for entertainment purpose only. It is not meant as comprehensive research or a commendation of any sort. Please speak with your financial advisor to discuss your particular situation, before putting any of your hard earned money into markets.