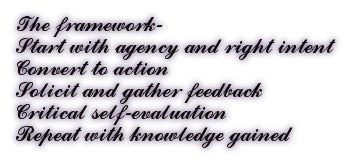

One of my favorite benefits of writing somewhat regularly, is being able to revisit an old self. Check in to see how things worked out for ‘that’ guy, you know? So in 2019 I shared a framework to leading a meaningful life. And have endeavored to use it ever since. Sometimes not very successfully, I might add. It’s been some crazy intervening few years, with unexpected plot twists and blind turns along the way. As the first full year post-pandemic comes to a close. I wanted to share some of my thoughts from the ‘before’ times. They helped me take stock of where things stand ‘now’ vs. in the ‘not so distant past’. Has one been able to iterate and improve or become predictable and ossified? For you to weigh in too…

A worthy exercise I think…open to your thoughts, jeers, encouragement and rotten tomatoes as always!😉

And — If you find this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Happy Holidays!

Cheers,

Faiz

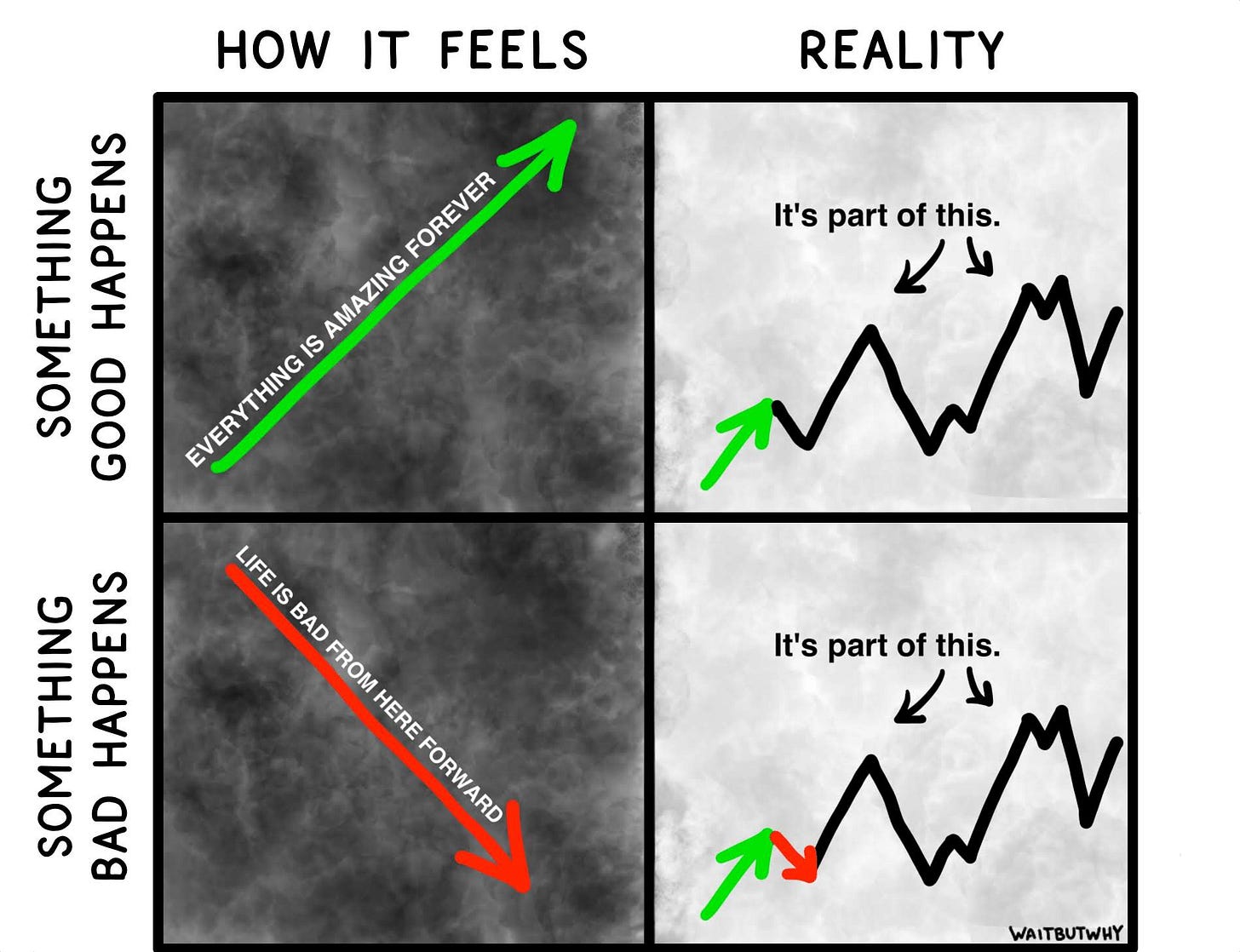

Our decisions in life and markets are bets on an uncertain and unknowable future. The framework proposed below is deceptively simple. Generally, where we sit is a function of where we stand. The ability to stick with a process based approach, rather than an outcomes based reactionary one, is difficult. And yet, the benefits of doing so are immensely rewarding. Not the least of which, is mental fortitude to handle widely variant outcomes, despite a constant input.

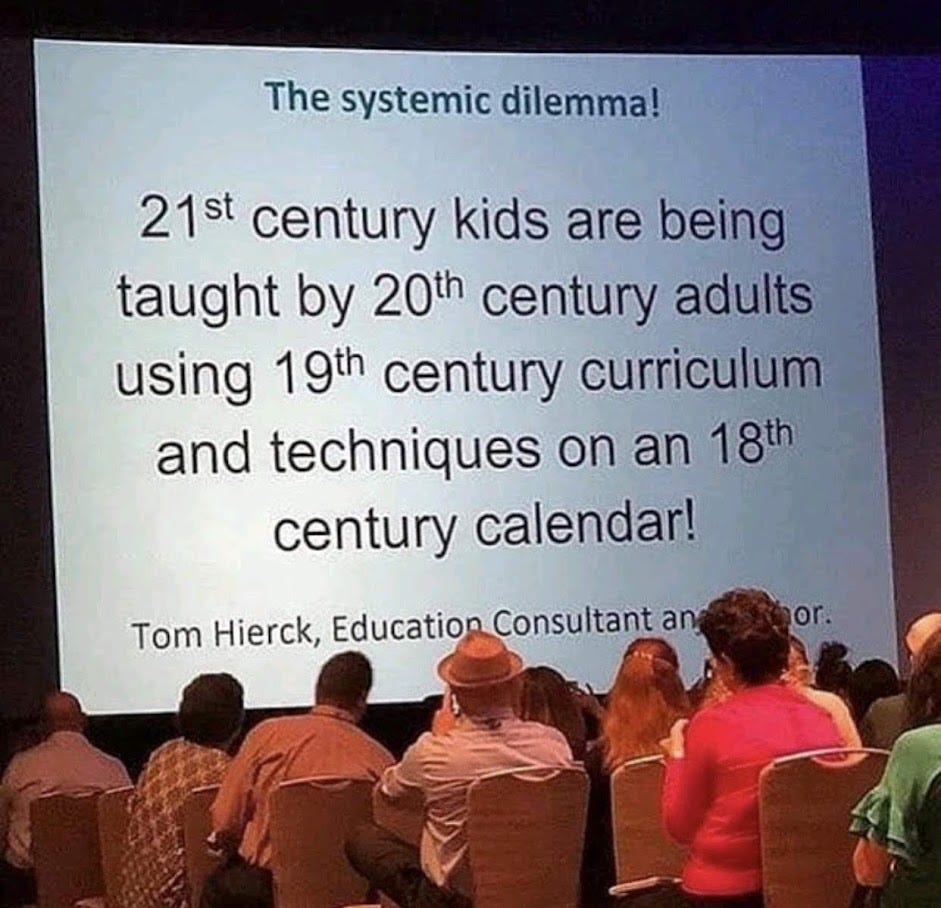

Having clear intentions behind actions produces a unique perspective. One where delineations along the way become learning opportunities, rather than obstacles. Inverting this thought, even the best laid plans and actions, lead to nothing more than fleeting success. Unless they begin with a clear goal or intent. For why we must take them on to begin with (and that’s the hardest part). Raising two young children (now teenagers!) I’m constantly privy to this struggle. Many parents feel the need for prioritizing efficiency (time or otherwise). Expecting that children simply follow orders. Let’s acknowledge instead that it’s a slow path towards independence and personal responsibility. It is one which we have all struggled on at some point. Giving ourselves and our children time to make decisions in a careful and deliberative manner is a necessary life skill. (The kids are worth it - Knowledge Project Podcast with Barbara Coloroso) As is agency, another essential ingredient for our journey. Agency defined as the ability to deliberate on, arrive at, act on and live with the consequences of our decisions. Only agency allows for an individual to form the right intent.

Agency makes a huge impact on intentions for the future. Having clear intentions can help with aspirations of living a healthy lifestyle, maintaining cordial relations and even building financial savings. It all begins with taking personal responsibility and agency for the future we want to create. (Brookings Institute - The Sequence of Personal Responsibility)

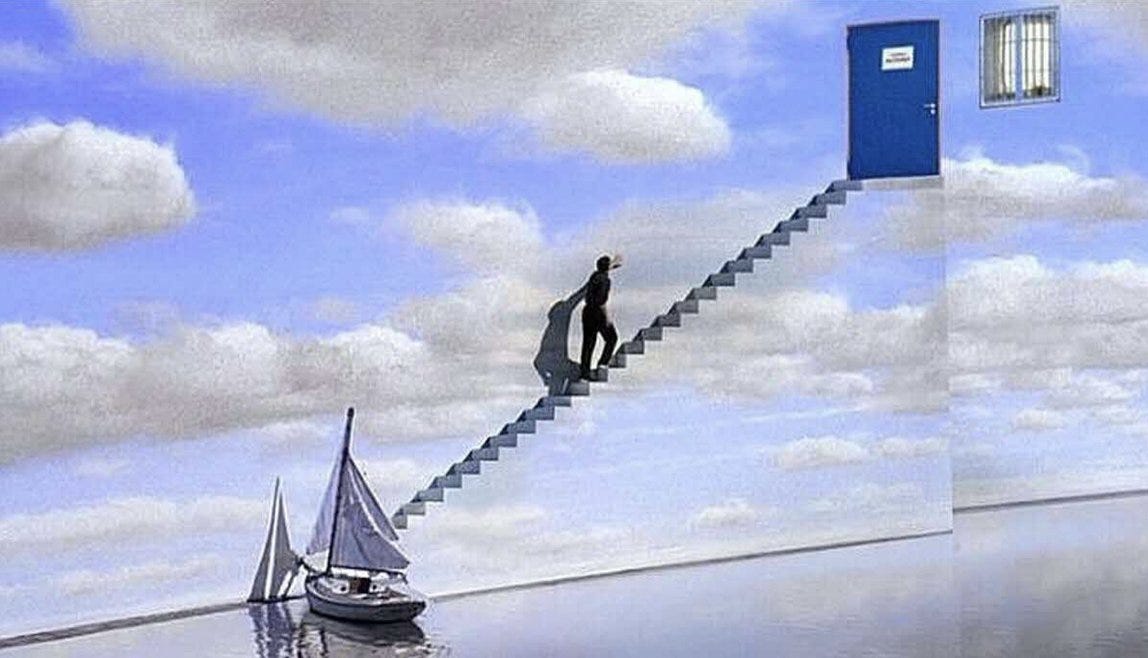

While it’s good to have good intentions which we can talk about and share, talking and sharing are in themselves not enough. Action must follow and often this is where professional help should come in. Seeing our future is a task made harder by our hard wired evolutionary propensities. Taking a wide variety of viewpoints on prospective actions cannot be faulted. But great talkers usually make the worst doers. Having someone to help hold the mirror to inaction (or otherwise ‘bad’ actions) is wise. A trusted mentor and advisor must provide this service. Action alone can produce the results we so desperately need.

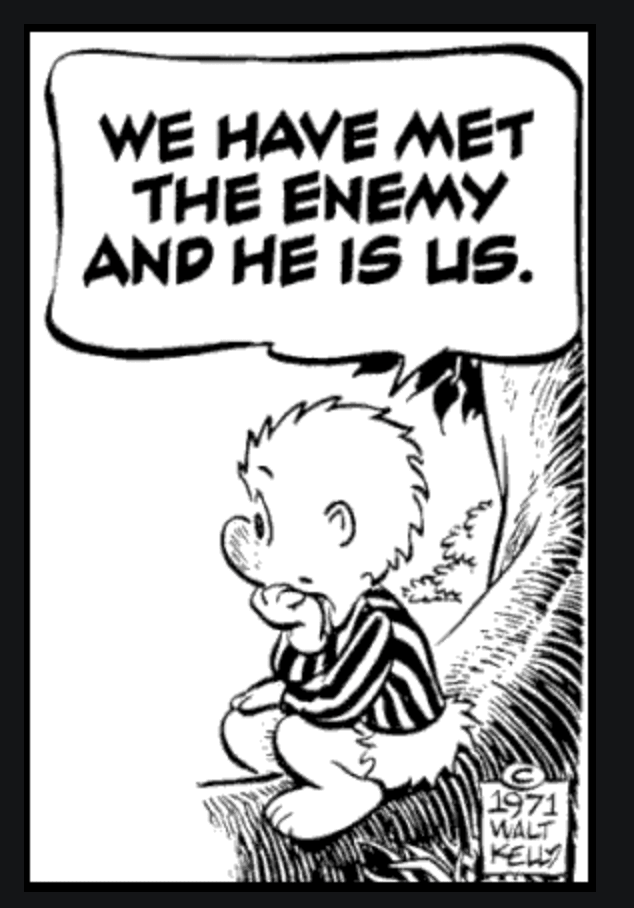

From Newton’s third law of motion- to every action there is always opposed an equal reaction. So once an action is taken, the reactionary feedback we receive on it must be well regarded. An integral part of living and investing is taking measured and mitigated bets on future outcomes of our actions. The arc of good and bad decisions swings. Alternating between chronic miscalculations on one end and the unsurprising virility of our good fortune on the other. Benjamin Franklin counseled- love your enemies because they tell your faults. We could read that as- love your mistakes and their consequences, because from them you learn much more than any great success.

Markets and life both allow a vibrant and willing arena, for us to exalt our best and forget the worst of our foibles. In large part to the probabilistic nature of the world around us, there are few if any sure things. A critical self-evaluation mechanism, that enables us to review and re-calibrate our decision making, is central to improving the process. Following in the ways of a stoic philosopher, we must first look to change and improve ourselves. Our actions are the only things we truly control (We Should Value What's In Our Control by Epictetus).

Every day we face countless decisions that we are ill equipped to address based on our finite knowledge and first hand experiences. Having a repeatable framework, one that is updated based on our prior experiences. This is a good approximation of Bayesian thinking in practice (How an 18th-century priest gave us the tools to make better decisions). An honest first step forward is lit by the right intentions. Looking at our past experiences. Especially our missteps, with unflinching honesty, will vouchsafe our bets on an unknowable future. An iterative process to improve both our life and investing, must be one that adapts with the growth of our own knowledge and experience.

Have you got an algorithm for life that works for you? Can you share it below or (if you prefer anonymity) directly with me?

If you made it this far….have you checked out the Scorecard yet? Please do…🙏

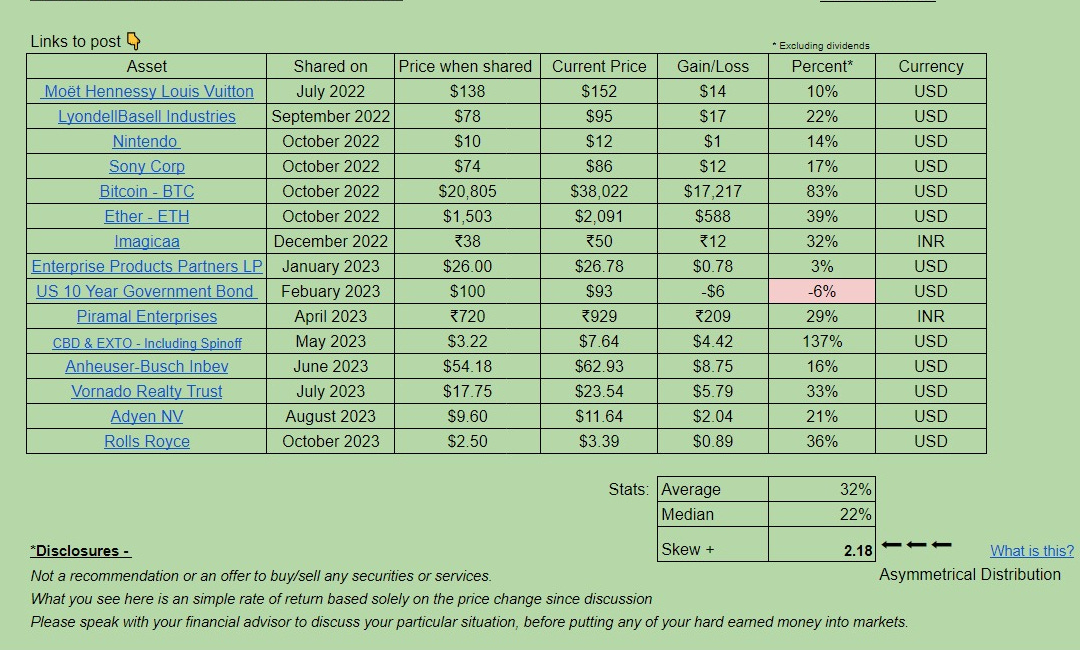

Scorecard -

·I hope the greatest measurable impact of reading these missives is original thought. An intellectual endeavor of writing about markets and invoking thought is the goal. But a standard external measure of validation also has its place. And for investment related efforts, really quite straightforward.

Good post ! Always good to reminisce !

Thank you! Sure is ☺